尽管预计芯片上升周期将在短期内持续,但地缘政治风险可能会对明年及以后的亚洲出口商构成更大的障碍。

While the chip upcycle is expected to continue in the near term, geopolitical risks could pose a bigger hurdle for Asian exporters next year and beyond.

虽然亚洲仍然是全球供应链的主要生产中心,但我们现在看到各国之间出现了分化。

While Asia remains the main production hub for the global supply chain, we are now seeing a divergence between countries.

例如,越南正在成为半导体领域更重要的贸易伙伴。这可能是中美技术贸易紧张局势升级的结果;随着芯片制造商的供应链多元化,越南似乎是最大的受益者。与此同时,今年上半年对中国的芯片出口有所复苏——但这主要是受价格效应的推动。中国和香港仍然占据半导体行业的中心位置,而韩国与中国和香港的贸易量自 2022 年以来一直在萎缩。

For example, Vietnam is becoming a more important trading partner in the semiconductor sector. This may be the result of escalating tensions between China and the US over technology trade; As chipmakers diversify their supply chains, Vietnam appears to be the biggest beneficiary. Meanwhile, chip exports to China recovered in the first half of the year - but this was mainly driven by price effects. China and Hong Kong still occupy a central position in the semiconductor industry, while South Korea's trade volume with China and Hong Kong has been shrinking since 2022.

South Korea's top 10 trading partners

韩国的十大贸易伙伴

韩国信息和通信技术 (ICT) 行业增长强劲,这主要得益于当前全球科技周期的回升。韩国芯片制造商受益于美国近期人工智能技术投资的增加以及内存价格的回升。

South Korea's information and communications technology (ICT) sector is growing strongly, largely thanks to the upturn in the current global technology cycle. South Korean chipmakers have benefited from a recent increase in investment in artificial intelligence technology in the United States and a recovery in memory prices.

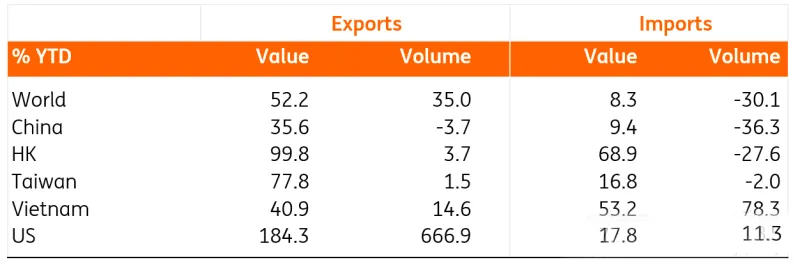

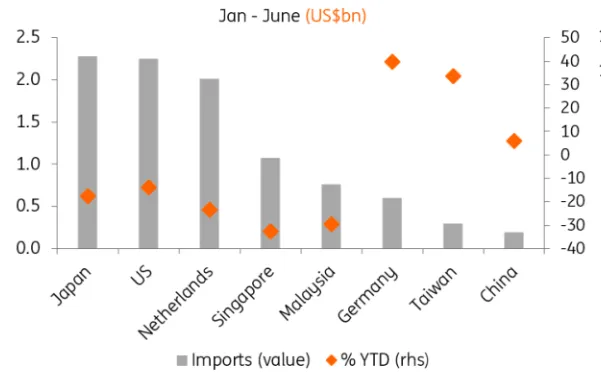

今年上半年,韩国芯片出口和进口分别增长了 52.2% 和 8.3%,但从数量来看,出口增长了 35%,而进口下降了 30%。

In the first half of this year, South Korea's chip exports and imports increased by 52.2% and 8.3%, respectively, but in terms of volume, exports increased by 35%, while imports fell by 30%.

2024 年上半年韩国芯片贸易强劲增长。有利的价格效应推动了这一数字:

Korea's chip trade grew strongly in the first half of 2024. Favorable price effects drove this figure:

图:韩国芯片贸易强劲增长

Chart: Strong growth in South Korea's chip trade

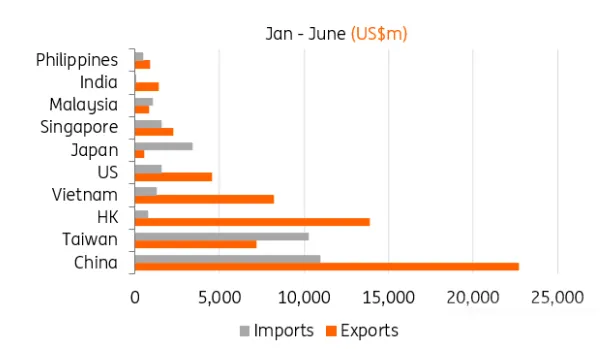

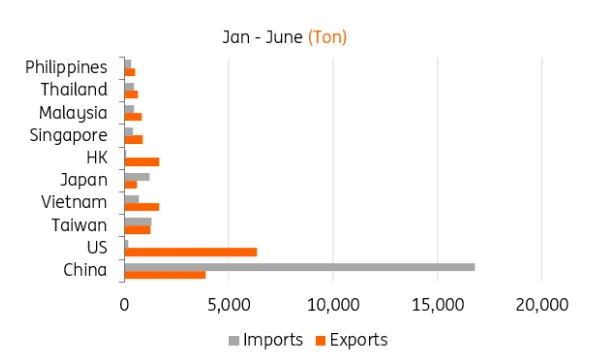

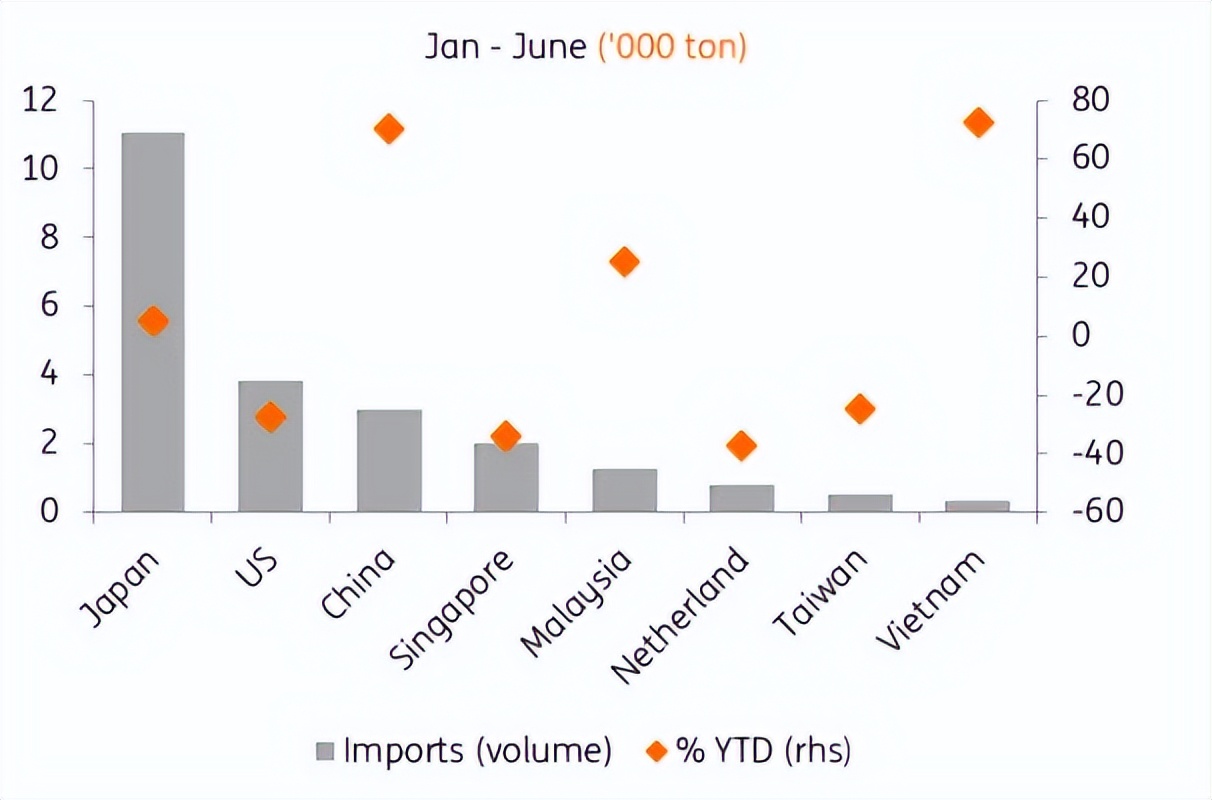

韩国出口数据显示,其十大芯片贸易伙伴都在亚洲,进一步巩固了亚洲作为全球芯片中心的地位。

South Korea's export data shows that its top 10 chip trading partners are all in Asia, further consolidating Asia's position as a global chip hub.

从价值上看,韩国与中国和香港的贸易总额占芯片贸易总额的 76% 以上,从数量上看,约占贸易总额的 52%。我们还发现,与十年前相比,越南的作用已显著增强,而印度虽然仍是一个小角色,但似乎最近已进入半导体领域。

In terms of value, South Korea's trade with China and Hong Kong accounted for more than 76% of the total chip trade, and in terms of volume, about 52% of the total trade. We also find that Vietnam's role has increased significantly compared to a decade ago, while India, while still a small player, appears to have recently entered the semiconductor space.

图:韩国十大芯片贸易伙伴

Figure: South Korea's top 10 chip trading partners

Position in semiconductor equipment field

发达经济体在半导体设备领域地位

从半导体制造设备来看,发达国家仍然具有比较优势。日本领先市场,其次是美国、荷兰、德国和以色列。今年上半年,韩国的设备进口量(-17.7%)和进口额(-4.5%)均有所下降,但这可能是由于生产基地的全球化。韩国半导体公司正在海外建立生产基地,尤其是在美国。

From the perspective of semiconductor manufacturing equipment, developed countries still have a comparative advantage. Japan leads the market, followed by the United States, the Netherlands, Germany and Israel. In the first half of this year, Korea's equipment imports (-17.7 percent) and imports (-4.5 percent) both declined, but this may be due to the globalization of production bases. South Korean semiconductor companies are building production bases overseas, especially in the United States.

图:2024 年上半年韩国芯片制造设备进口量下降

Figure: South Korea's imports of chip manufacturing equipment declined in the first half of 2024

在半导体行业,与韩国和台湾相比,日本并不是半导体强国,但日本在半导体制造设备方面确实具有技术优势。

In he semiconductor industry, Japan is not a semiconductor powerhouse compared to South Korea and Taiwan, but Japan does have a technological advantage in semiconductor manufacturing equipment.

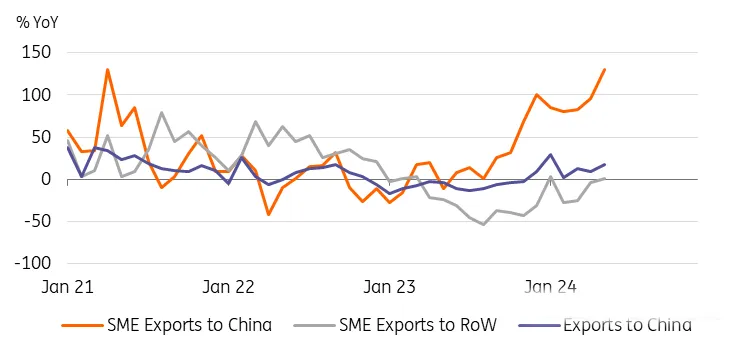

日本一直是美国对华半导体制裁的积极参与者,因此我们最初预计今年日本对华出口将受到负面影响。然而,事实证明,日本对华出口,尤其是半导体制造设备,大幅增长。

Japan has been an active participant in U.S. semiconductor sanctions against China, so we initially expected a negative impact on Japanese exports to China this year. However, Japan's exports to China, especially semiconductor manufacturing equipment, have proved to be surging.

美国加大力度减缓中国半导体工艺开发,似乎正推动中国抢先购买芯片制造设备,以应对未来更严格的出口监管。因此,技术出口禁令实际上暂时对日本对华出口产生了积极影响。我们发现,日本对华半导体机械出口大幅增长,而对世界其他地区的出口则表现平平。

Increased US efforts to slow China's semiconductor process development appear to be pushing the country to buy chip manufacturing equipment in advance of tougher export regulations in the future. As a result, the technology export ban has actually temporarily had a positive impact on Japanese exports to China. We found that Japan's exports of semiconductor machinery to China increased significantly, while exports to the rest of the world were flat.

图:日本芯片制造设备出口仅向中国增长

Chart: Japanese chip-making equipment exports grew only to China

据行业报告,中国一直在提高产能,主要是后处理阶段,包括封装和测试。目前这还不受任何制裁措施的约束。光刻产品用于制造 28 纳米或更大的封装,这意味着该技术已经有十多年的历史了。一般来说,后处理通常涉及各种零件和产品的手工组装。这就是为什么大多数工厂都集中在劳动力丰富的中国和东南亚。

According to industry reports, China has been ramping up production capacity, mainly in the post-processing stage, including packaging and testing. This is not currently subject to any sanctions. Photolithography products are used to make packages of 28 nanometers or larger, which means the technology has been around for more than a decade. In general, post-processing usually involves the manual assembly of various parts and products. That's why most factories are concentrated in labor-rich China and Southeast Asia.

日本的出口似乎主要是光刻设备,该设备不在美国的技术出口禁令名单上。然而,后工序在整个制造过程中几乎占代工厂总份额的 76%。

Japan's exports appear to be mostly lithography equipment, which is not on the U.S. technology export ban list. However, the post-production process accounts for almost 76% of the total foundry share in the entire manufacturing process.

从长远来看,美国希望通过在与美国关系更友好的国家批量生产半导体来降低其在中国的供应链风险。然而,由于劳动力成本高昂,对生产线自动化技术的投资可能会成为焦点,包括英特尔、台积电和三星电子在内的许多公司都在日本投资后处理。日本政府还将半导体指定为对经济安全至关重要的行业,并大幅增加了预算来支持它们。因此,我们预计日本对半导体的投资将在未来几年增加,日本将在后处理部分发挥更重要的作用。

In the long term, the United States hopes to reduce its supply chain risk in China by mass-producing semiconductors in countries with friendlier relations with the United States. However, investment in production line automation technology is likely to come into focus due to high labor costs, with many companies including Intel, TSMC and Samsung Electronics investing in post-processing in Japan. The Japanese government has also designated semiconductors as an industry critical to economic security and has significantly increased its budget to support them. As a result, we expect Japanese investment in semiconductors to increase in the coming years, with Japan playing a more significant role in the reprocessing segment.

最新贸易数据证实,全球对半导体的需求强劲,需求主要来自美国和中国,原因各不相同。美国市场与人工智能技术更相关,而中国市场的需求将加速增长,因为在贸易禁令进一步收紧之前,中国正在努力提高技术自给自足能力。事实上,韩国半导体制造商似乎正在减少对中国的依赖,这种情况在过去一两年里一直在进行。

The latest trade figures confirm that global demand for semiconductors is strong, with demand mainly coming from the United States and China for different reasons. The US market is more related to AI technology, while demand in the Chinese market will accelerate as the country strives to become more self-sufficient in technology before the trade ban is further tightened. In fact, South Korean semiconductor manufacturers appear to be reducing their dependence on China, which has been underway for the past year or two.

尽管预计芯片上升周期将在短期内持续,但地缘政治风险可能会对明年及以后的亚洲出口商构成更大的障碍。

While the chip upcycle is expected to continue in the near term, geopolitical risks could pose a bigger hurdle for Asian exporters next year and beyond.